Description

Course Contents

- Introduction to the nature of Stock market dynamics

- Market psychology comprising of Mass traders vs fund managers

- Understanding construct of the Technical analysis to read the stock behaviour

- Scenario building using the simplified approach of using Tools of Technical Analysis

- Introduction to the Concepts of Derivatives as Risk Management tools

- Measuring Traders confidence with concept of Open Interest analysis

- Understanding the play of Interest vs risk in Cost of Carrying

- Reading the Derivatives pricing with underplay of key 1st & 2nd Generation Greeks e.g. Delta, Theta, Gamma, Vega, Rho

- Establishing the strength of price movement for trading strategies with build-up, covering and unwinding

- Assessment of price Volatility for risk underwriting and coverage

- Identify Technical breakouts, patterns and projections for minimizing the drawdown

- Find out the stock projection supported by product and technical framing methods

- Capital protection using risk and money management

- Simple Options strategies for bullish, bearish, neutral and event-based market.

- Introduction to the Concepts of Option Synthetics in Trade Positions

- How to win the loosing Traders using the Position Morphing

- Options Series and using Greeks to trade market events with volatility

- How to trade on the day of expiry for maximum profitability

- Procuring derivative data using free and low cost resources for retails to read the complete data story

- Stock screening from large market using data and self customized indicators

Course Format

Discourse: Online / Class Room

Group Coaching: 16 Hours

Period: 2 Days / 8 Days

Live Market Sessions (3 Days)

9:00 – 9:30 AM

11:00 – 11:30 AM

3:00 – 3:30 PM

Exit Test and Certification

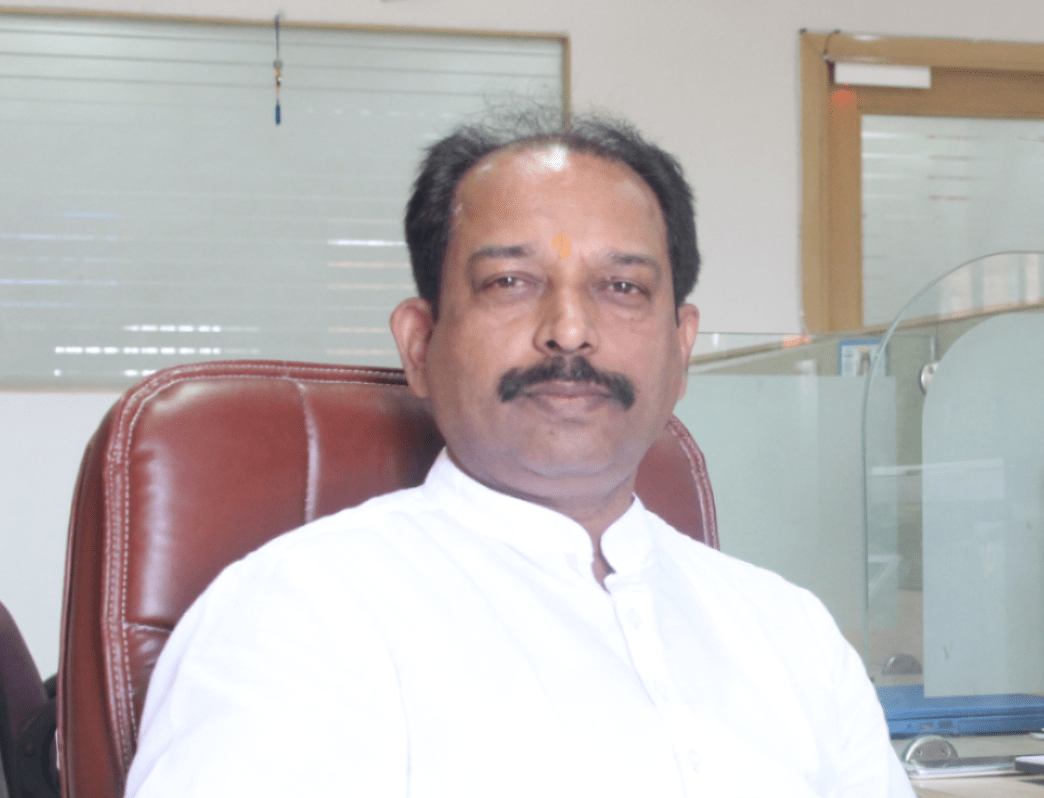

Course Faculty

Mr Ajay Agarwal, a Pro Trader cum Educationist, also referred to as Option Guru who has over 29 years of experience in derivative data analysis, technical analysis and trading strategies. He has also trained for reputed institutions like ICICI Direct, India Info line,NSE Academy and Institute of Chartered Accountants of India (ICAI).